Automated Underwriting Risk Mitigation for High-Risk Payment Processors

Client Objective

Our client, a leading high-risk payment processing firm, sought a robust solution to streamline underwriting processes, significantly reduce compliance costs, and accelerate onboarding time for new clients. They emphasized a cost-effective, scalable system that minimized manual review and maximized real-time risk management.

Challenges

- Extensive manual underwriting procedures consuming significant resources.

- High operational costs due to a large compliance team.

- Lengthy client onboarding periods affecting revenue.

- Need for accurate, real-time decision-making to manage risk dynamically.

- Requirement to host the solution securely on the client's private servers.

Shefa Solutions' Customized Approach

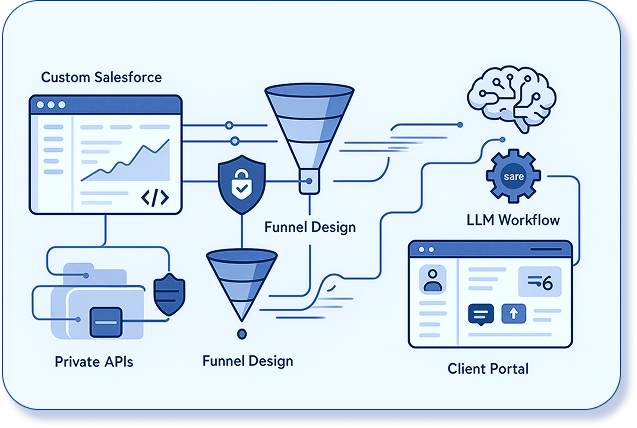

APIs

- Integrated TransUnion’s TLOxp background-check Api for real-time identity verification and risk assessment.

- Reduced development time and costs by using trusted, reliable existing data sources.

custom API

- Designed a fully customized Api connecting client portals directly to the underwriting engine.

- Embedded bespoke scoring models and risk thresholds tailored to compliance guidelines.

- Implemented automated flagging systems to swiftly identify, escalate, and decline high-risk applications.

AI

- Integrated fine-tuned open-source large language models (LLMs) to dynamically analyze unstructured applicant data.

- Configured ML algorithms to continuously learn from historical and real-time data, improving underwriting decisions.

infrastructure

- Developed and deployed the infrastructure securely within the client’s private servers, ensuring compliance and security standards.

Impact and Results

Efficiency:

- Automated solution reduced underwriting processing time from days to seconds per application.

- Freed up four compliance officers from routine tasks, allowing them to focus on complex compliance issues.

Savings:

- Significant reduction in operational and overhead costs, enhancing profitability.

- Reduced need for ongoing manual audits and compliance checks by over 75%.

Risk Management:

- Real-time analytics provided immediate risk alerts, enabling dynamic adjustment of risk thresholds.

- Enhanced accuracy in risk prediction, reducing incidents of fraudulent onboarding and associated losses.

Conclusion

Shefa Solutions successfully delivered a streamlined, scalable underwriting system tailored precisely to our client's specifications, effectively balancing innovation with practicality. This solution exemplifies our commitment to developing fully customized, intelligent technology that significantly enhances operational efficiency, risk management, and cost-effectiveness.